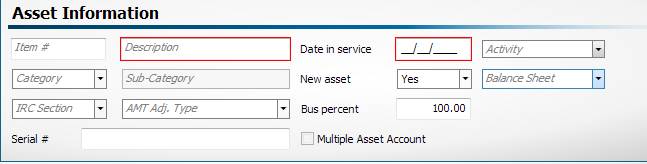

Asset Information Pane

Fixed Assets - Asset Information Pane

The Asset Information Pane is the starting point for entering a new asset. Your rolled over data is automatically entered in this section. For all new assets, complete the Asset Information Pane, and then enter at least a cost or basis on the Depreciation and Section 179 tab. Complete the Auto/Listed and Dispositions tabs as needed.

Asset Information Pane fields:

- Item#: A unique item number for the asset (created by the user to identify the assets).

- Description: A description of the asset.

- Date in service: The date the asset was placed in service.

- Activity: Any business activity form added to the return will show in the activity list. Select from the list to assign the asset to a business activity form. Some business activities can have several copies and may be appended with :01, :02 and so forth.

- Category/Sub-Category: Select from a category and subcategory to enable defaults for recovery period, method, and convention.

- New asset: Indicates if the asset meets original use requirements for bonus depreciation.

- Balance Sheet: Sends the depreciation to the balance sheet (Schedule L) of business forms.

- IRC Section: Internal Revenue Code Section for amortized assets for page 2 of Form 4562.

- AMT Adj. Type: For amortized assets, this affects the AMT column’s recovery period.

- Bus percent: Percentage the asset was used for business use. ATX defaults this to 100%.

- Serial #: Serial number of the item, if applicable.

- Multiple Asset Account: Check to designate this asset as the parent in a multiple asset account. (This check box is only active and available in Enhanced Asset Management.

See Also: